Contents:

There are craftsmen, bookkeepers, taxi drivers among them, who could easily fit into our methods of industrial and social life. The third category includes most of the skilled artisans, such as bakers, blacksmiths, carpenters, mechanics, plumbers, and tailors as well as skilled factory workers, policemen, and bookkeepers. We know the best professionals in every industry, at every budget.

- Previous work experience makes finding clients as a bookkeeping business owner much easier.

- Bookkeepers don’t require a license but can choose to obtain a certification.

- Each certification or designation allows them to provide a specific set of services to businesses.

- In the broadest sense, bookkeepers help businesses keep their finances intact by keeping tabs on different accounts, transactions, and reports.

- They are responsible to keep you up to speed with your financial situation.

You may make more money long-term if you leave the accounting to the experts and focus on your growth prospects. It may take some background research to find a suitable bookkeeper because, unlike accountants, they are not required to hold a professional certification. A strong endorsement from a trusted colleague or years of experience are important factors when hiring a bookkeeper. When looking for a certified bookkeeper, first decide if you want to hire an independent consultant, a firm or a full-time employee if your business is large enough. Ask for referrals from friends, colleagues or your local chamber of commerce, or search online social networks like LinkedIn for bookkeepers.

Proven bookkeeping expertise

Simply put, bookkeepers are responsible for all financial activity and oversight of a business. They record and organize financial statements, ensure compliance with important tax rules, and facilitate all ingoing and outgoing payments on specific business accounts. The team of QuickBooks Live Bookkeepers includes professionals from almost all industries.

Industry up 12 percent in February, per Blair/PCO M&A Specialists … – Pest Management Professional magazine

Industry up 12 percent in February, per Blair/PCO M&A Specialists ….

Posted: Tue, 28 Mar 2023 07:00:00 GMT [source]

The responsibilities you need someone to fulfill depend on the bookkeeper or bookkeeping service that your business needs. Each bookkeeping professional has their own expertise, just like each business has unique financial circumstances and bookkeeping needs. These financial reports show a businesses bottom line and operating expenses, the balance of assets and liabilities as well as the cash flowing in and out of the business.

Top 10 Bookkeepers near you

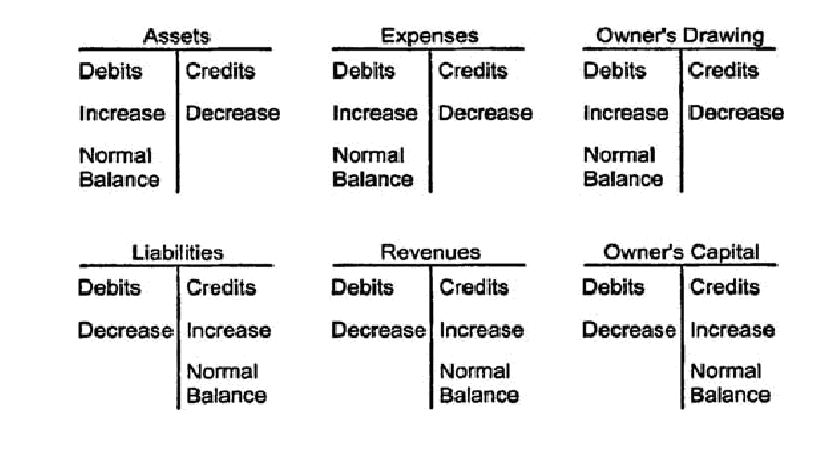

A bookkeeper is a professional who is responsible for managing and recording financial transactions for a company or organization. Bookkeepers are responsible for maintaining accurate records of all financial transactions, including sales, purchases, receipts, and payments. They record these transactions in a general ledger, which is a bookkeeping system that provides a record of all financial transactions.

The bottom line is that small companies—those defined by the SBA as having fewer than 500 employees—will still need bookkeepers, particularly in the short term, and a lot of them. There are high stakes when managing a business’s financial statements, which can lead to stress. However, if you have a rigorous organizational system and a solid knowledge of rules and regulations, it can be straightforward and easily manageable.

Which Accounting Jobs Are in Demand?

Your business’s accounting needs might not require the in-depth expertise of a hired professional. You might also be watching your company’s list of expenses and wondering where to reduce spending. In either case, consider handling the accounting yourself or delegating this responsibility to one or a few of your current employees. Each certification or designation allows them to provide a specific set of services to businesses. The rate a bookkeeper charges is based on various factors, including how much work you need done, the level of expertise you are seeking, and the state in which you do business.

Bookkeepers help manage your day-to-day finances to ensure your finances are in order. They record income and outflow of money, property, and other financial assets. The most important bookkeeper duty is to record and review all financial data accurately. To excel as a bookkeeper, you must pay close attention to details and be very accurate when recording numerical data. The bookkeeping job will also require you to be ethical and to maintain the confidentiality of a client’s financial records.

You can solve issues quickly and plan for the future of your business with newfound knowledge of your financial situation. We can replace your back office with accounting, payroll, and bookkeeping support. So just in case of accidental loss or deletion, our accounting cloud solutions regularly back up everything housed in your cloud, nightly. In 2023, offering client accounting and advisory services is a must. Industries that work with complex financial systems and high-volume transactions require accountants (i.e., government agencies, colleges, hospitals, etc.). If you invoke the guarantee, QuickBooks will conduct an evaluation of the Live Bookkeeper’s work.

However, if you need insight and advice on how to better operate your business at scale…you will need help from an accountant. Accounting and bookkeeping similarities and differences, and how to determine which to hire. Have your questions answered and learn more about QuickBooks Live Bookkeeping. Forensic accountants investigate financial crimes involving fraud, embezzlement and other issues.

Who licenses CPAs?

Bookkeepers work in a variety of settings, depending on the nature and size of the organization they serve. They may work in an office environment, in a retail store, or even from home. In most cases, bookkeepers work full-time during regular business hours, although part-time and flexible schedules are also common. We have bookkeepers in our industry who have been with us 60 years, but that does not make them chartered accountants.

- Keeping the books is just one of the tasks modern bookkeepers might handle.

- Throughout history, short-term niggling bookkeepers have made wrong decisions.

- Unlock the potential in your business so that you can move from overwhelmed bookkeeper, feeling stuck and not sure what to do next, to thriving bookkeeping business owner living your best business life.

At this point, you could confidently answer, “What does a bookkeeper do? ” You could also list their primary job duties and recognize the benefits of bookkeeping. If you’re thinking about hiring a bookkeeper or want to improve your business’s bookkeeping operations, consider your bookkeeping options. As a business owner, one of your primary responsibilities could be keeping tabs on your product inventory and restocking it when needed. When you order inventory, your bookkeeper collects the receipt, enters the transaction into the general ledger, and files the record into your financial database.

You simply just need to fill out the form you find here and Ageras will do the rest. Compare the non-binding quotes and choose the option that suits you best. We will contact you for further details if needed and send you up to 3 quotes from qualified bookkeepers. Certain cloud hosting providers incorporate built-in alerts into their products, in case unauthorized users attempt to gain access to a system.

How do real estate accounting services improve clients’ finances? – Arizona Big Media

How do real estate accounting services improve clients’ finances?.

Posted: Wed, 19 Apr 2023 04:25:40 GMT [source]

CPB candidates can also buy a bundle package from NACPB to save on classified balance sheets. Explore programs of your interests with the high-quality standards and flexibility you need to take your career to the next level. Bookkeeping attracts finance-oriented people with strong attention to detail and solid math skills. Learning how to become a bookkeeper is also a great career choice if you like the idea of working remotely. They are partly tackling the problem with some additional money, but their announcement that they will spend £19 billion would make any double-entry bookkeeper blush.

These will help prove your expertise in specific bookkeeping and accounting software to clients. These exams test your knowledge of analyzing business transactions, payroll taxes, financial statements, and more. Although you don’t need a bachelor’s degree, it can make you more competitive. Only 12% of entry-level bookkeepers have a bachelor’s degree, so having one is an easy way to gain an advantage.