Contents:

Sectoral breakdown of the latest in business, stock markets and economy. Beyond what we have stated above, we have also rated BRZE for Sentiment, Stability, and Value. Of 169 stocks in the F-rated Software – Application industry, BRZE is ranked #81. And it’s about to change everything we know about everything. According to Grand View Research, the global AI boom could grow from about $137 billion in 2022 to more than $1.81 trillion by 2030. And investors like you always want to get in on the hottest stocks of tomorrow.

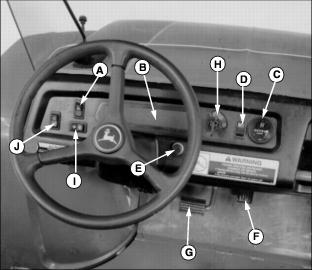

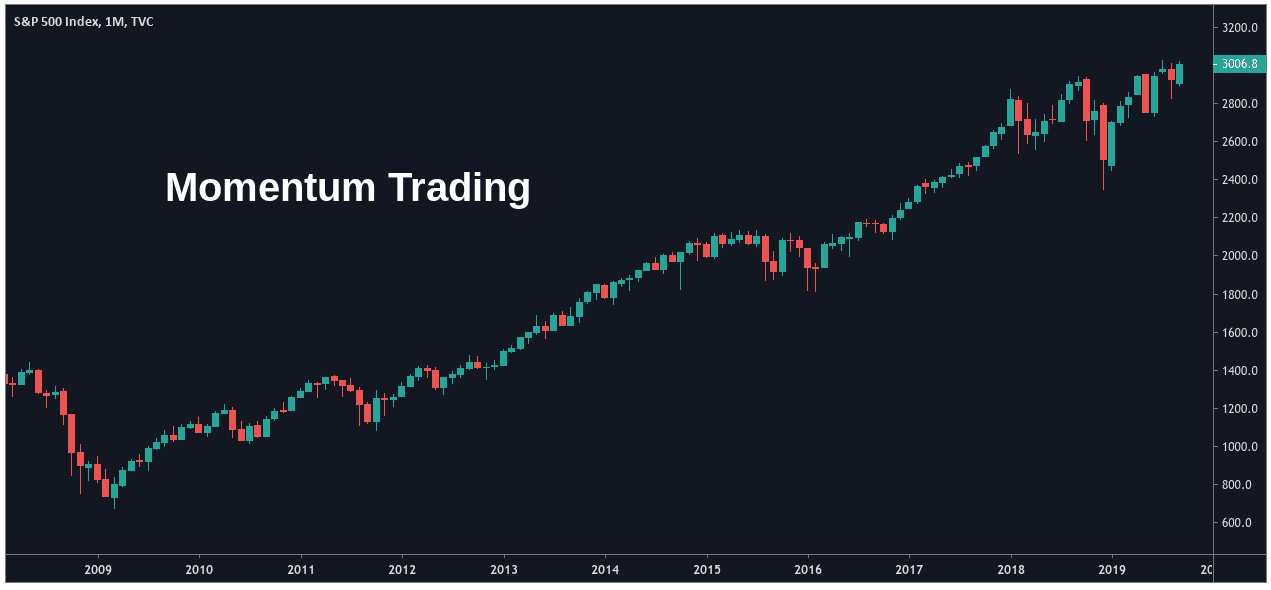

When taken as whole, stock gets a rating of Overweight and that encourages the investors to exploit the opportunity and build their stake up in the company. The chart below shows how a company’s ratings by analysts have changed over time. Each bar represents the previous year of ratings for that month. Within each bar, the sell ratings are shown in red, the hold ratings are shown in yellow, the buy ratings are shown in green, and the strong buy ratings are shown in dark green. Options trading entails significant risk and is not appropriate for all investors.

We’re Hopeful That Braze (NASDAQ:BRZE) Will Use Its Cash Wisely

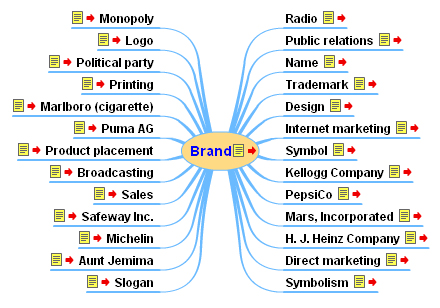

Braze, Inc. operates a customer engagement platform that provides interactions between consumers and brands worldwide. The company was formerly known as Appboy, Inc. and changed its name to Braze, Inc. in November 2017. Braze, Inc. was incorporated in 2011 and is headquartered in New York, New York. Further, it offers personalization products, such as liquid templating platform, connected content platform, content blocks, intelligent timing platform, and promotion codes; and action products. Braze, Inc operates a customer engagement platform that provides interactions between consumers and brands worldwide. Braze, Inc. is a provider of customer engagement platform that enables customer-centric interactions between consumers and brands.

Similar to SIPC protection, this additional insurance does not protect against a loss in the market value of securities. Webull Financial LLC is a member of SIPC, which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). An explanatory brochure is available upon request or at Our clearing firm, Apex Clearing Corp., has purchased an additional insurance policy.. Securities trading is offered to self-directed customers by Webull Financial LLC, a broker dealer registered with the Securities and Exchange Commission . Webull Financial LLC is a member of the Financial Industry Regulatory Authority , Securities Investor Protection Corporation , The New York Stock Exchange , NASDAQ and Cboe EDGX Exchange, Inc . If you would like to know where to buy Breezecoin at the current rate, the top cryptocurrency exchanges for trading in Breezecoin stock are currently ProBit Global, and BitGlobal.

View All

Cryptocurrency execution and custody services are provided by Apex Crypto LLC through a software licensing agreement between Apex Crypto LLC and Webull Pay LLC. Cryptocurrency trading is offered through an account with Apex Crypto. Apex Crypto is not a registered broker-dealer or FINRA member and your cryptocurrency holdings are not FDIC or SIPC insured. Please ensure that you fully understand the risks involved before trading. Not all coins provided by Apex Crypto LLC are available to New York residents.

- Below are the latest news stories about BRAZE INC that investors may wish to consider to help them evaluate BRZE as an investment opportunity.

- Barchart is committed to ensuring digital accessibility for individuals with disabilities.

- Its 30.50 forward Price/Sales multiple is 638.1% higher than the 4.13 industry average.

The liquidity ratio also appears to be rather interesting for investors as it stands at 2.68. While BRZE has a C rating in our proprietary rating system, one might want to consider looking at its industry peers, Open Text Corporation , Progress Software Corporation , and National Instruments Corporation , which have an A rating. However, its loss from operations widened 18.9% from its year-ago value to $10.45 million. And its net loss widened 2.7% from the prior-year quarter to $9.06 million. Join thousands of traders who make more informed decisions with our premium features.

Provide specific products and services to you, such as portfolio management or data aggregation. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data. A stock’s beta measures how closely tied its price movements have been to the performance of the overall market. Braze For Success Evolve your customer engagement program with our award-winning services. Instantly get the right message to the right customers on any channel.

Canadian Securities Exchange (CSE)

Finally, Barclays cut their price target on shares of Braze from $50.00 to $45.00 and set an “overweight” rating for the company in a report on Wednesday, December 14th. Two research analysts have rated the stock with a hold rating and twelve have assigned a buy rating to the company. According to data from MarketBeat, the company currently has an average rating of “Moderate Buy” and a consensus target price of $41.00.

Volatility was left at 5.57%, however, over the last 30 days, the volatility rate increased by 6.56%, as shares surge +7.62% for the moving average over the last 20 days. Over the last 50 days, in opposition, the stock is trading +8.48% upper at present. According to analysts, Braze’s stock has a predicted upside of 31.35% based on their 12-month price targets.

Intrawhat is the difference between yield and return data delayed at least 15 minutes or per exchange requirements. We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management.

In the past three months, Braze insiders have sold more of their company’s stock than they have bought. Specifically, they have bought $0.00 in company stock and sold $157,347.00 in company stock. Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view. We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes.

Why braze?

Legal & General Group Plc grew its https://1investing.in/ings in Braze by 4.3% in the 4th quarter. Legal & General Group Plc now owns 8,303 shares of the company’s stock valued at $227,000 after buying an additional 340 shares during the period. Finally, Morgan Stanley grew its holdings in Braze by 21.4% in the 4th quarter. Morgan Stanley now owns 4,992,683 shares of the company’s stock valued at $136,200,000 after buying an additional 880,451 shares during the period. 44.13% of the stock is owned by institutional investors and hedge funds. Real-time analyst ratings, insider transactions, earnings data, and more.

Braze buys its ANZ region reseller North Star (NASDAQ:BRZE) – Seeking Alpha

Braze buys its ANZ region reseller North Star (NASDAQ:BRZE).

Posted: Thu, 30 Mar 2023 20:29:16 GMT [source]

Your website access and usage is governed by the applicable Terms and Conditions & Privacy Policy. As of July 2021, Braze had more than 1,000 global customers and in the last three years, the company claims that the scale of its platform has grown substantially. Braze claims that it has the potential to stay on top of the customer engagement evolution. The company claims that it can maintain this leadership position due to its teamwork and strategies.

- Sign-up to receive the latest news and ratings for Braze and its competitors with MarketBeat’s FREE daily newsletter.

- Specifically, they have bought $0.00 in company stock and sold $157,347.00 in company stock.

- The company can ingest and process customer data in real time, orchestrate and optimize contextually relevant, cross-channel marketing campaigns and continuously evolve their customer…

- In keeping analyst consensus estimate with, company is forecasted to be making an annual revenue of $352.46 million in 2023, which will be 48.10% more from revenue generated by the company last year.

- Over a period of past 1-month, stock came adding 8.95% in its value.

Its application combines messaging, audience segmentation, analytics and user support in a single integrated solution. The firm offers push notifications, email, in-app messages, and news feed services. The company was founded by Mark Ghermezian, William Magnuson, and Jonathan Hyman in 2011 and is headquartered in New York, NY.

One share of BRZE stock can currently be purchased for approximately $34.35. Sign-up to receive the latest news and ratings for Braze and its competitors with MarketBeat’s FREE daily newsletter. The P/E ratio of Braze is -23.37, which means that its earnings are negative and its P/E ratio cannot be compared to companies with positive earnings. High institutional ownership can be a signal of strong market trust in this company. MarketBeat has tracked 10 news articles for Braze this week, compared to 4 articles on an average week.