Contents:

Since a bank will want your Social Security number when you set up a personal account, this requirement isn’t unique to businesses. You already know that having a separate bank account for your business means better record keeping. Business bank accounts have a few more advantages closely related to these. Freelancers, gig workers, and independent contractors are all small business owners. So are many online merchants, owners of small shops, and countless others. Of small businesses use personal accounts for work-related finances.

Yes, you should have a separate account for your business for better bookkeeping. No fees for opening an account , and no initial deposit is required, no minimum balance is required. They can be deducted from the revenue generated by your business.

If you use your accept payments online account for business, your data entry had better be perfect. The only thing separating your business and personal finances is correct accounting categories. Minor errors could mix up your business and personal transactions and cost you money.

Especially if you’re looking to hire employees or turn your hobby business into a full-time career. Business bank accounts aren’t just there to separate your money. They can help verify your business when you apply for a credit card or business loan.

Can a business set up a Cash App account?

If you’re not using Instagram for business purposes, those potential new customers might never find their way to your products or services. Initial deposits and minimum balances vary from bank to bank, as well as depending on your business’ type. So it’s important to select a bank with an initial deposit and minimum balance that’s manageable to maintain. Transitioning can be as straightforward as directing all payments or transactions to your new account.

If you want to be sure the IRS recognizes the income you reported as being related to a business, not a hobby, then setting up a business checking account can serve as proof. One of the biggest differences between personal vs. business banking accounts is the application process and requirements. Keeping your personal and business finances separate is a smart idea to maintain accurate records, understand your business’ financial health, and make informed decisions. Even further, those separate accounts might not just be a recommendation—depending on your business, they could be a requirement.

Ready to start & grow your dream US

This complete guide will help you get started with social media marketing and follow the right best practices from day one. The added advantage here is that you can create your content in dedicated blocks of time and schedule it to post at the best time for your audience. Even if that time is outside business hours, on the weekend, or in the middle of the night.

Our services help you obtain all the legal documents needed to start your business the right way. The best part is, you can do it all easily rfrom your computer or phone. A business account also allows for checks to be written with the business name on them.

Samsung Galaxy S23 vs. Google Pixel 7: Which phone is better for you? – CNN Underscored

Samsung Galaxy S23 vs. Google Pixel 7: Which phone is better for you?.

Posted: Thu, 16 Mar 2023 13:13:00 GMT [source]

Even for small businesses, a business account can help ensure compliance with the Internal Revenue Service and simplify tax filing. With a business account, you’ll have access to more features designed to create less friction for day-to-day operations. It’s more difficult to move personal money into a corporation due to the formalities that need to be followed , so an LLC may be a better entity.

Open a business account with Wise – One stress-free account, multiple currencies

As a https://bookkeeping-reviews.com/ owner, you have many options for paying yourself, but each comes with tax implications. Forbes Advisor adheres to strict editorial integrity standards. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. The opinions expressed are the author’s alone and have not been provided, approved, or otherwise endorsed by our partners. This is just one scoring method and a credit card issuer may use another method when considering your application. These are provided as guidelines only and approval is not guaranteed.

TikTok Business vs. Creator account: What’s the difference? – Sprout Social

TikTok Business vs. Creator account: What’s the difference?.

Posted: Tue, 09 Aug 2022 07:00:00 GMT [source]

If you eventually do decide to establish an LLC or corporation, you’ll need separate accounts anyway. If you set them up while you’re still a sole proprietor , you’ll have less to do later. As soon as a customer pays his or her bill, the credit card bill can be paid. It’s normal for new business owners to use personal bank accounts to manage business finances, but there are real advantages to using business checking instead. If you plan to deduct business expenses on your taxes, having a separate business checking account can take the hassle out of organizing things when it’s time to file. You don’t have to sift through personal and business transactions to look for deductible expenses.

She has a degree in English Literature from Lewis & Clark College. Earn Chase Ultimate Rewards® on everyday purchases and redeem for travel, cash back and more. See all our rewards credit cards and choose one that’s right for you. How to build a strong credit history Building strong credit can be challenging when you are first starting out. Check out Chase’s tips on how to help build good credit history.

You can increase the limit by verifying your identity on the platform. There are no limits on the amount of money business accounts can receive. FDIC protections do not cover investment accounts, safe deposit boxes, life insurance policies or annuities. But if you have a business checking account or any of the other account types listed above, then you have the reassurance of knowing your money is covered up to the applicable limit. Money by QuickBooks, online business bank account options that do not charge monthly subscriptions or minimum account fees, for seamless insights into your business finances.

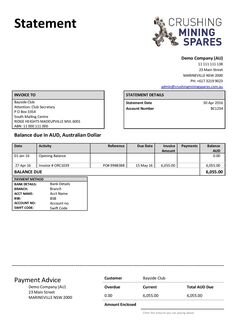

Yes, a business can set up a Cash App account by creating a personal account and converting it into a business profile. You can generate a payment link (your $cashtag) that you can text, email, message, or embed in your website. This link will take them to a “Cash.me” page where they can either log into their Cash App or enter their name and email address along with their credit or debit card information. Note that it’s possible to accept Cash App as a payment method without a Cash App business profile if you are a Square customer using compatible hardware or software. In this article, we’ll be looking at how to set up a Cash App business account, how to use Cash App for business vs. personal, and the strengths and limitations of the application. Negative numbers shown in the accounts of the Balance Sheet report indicate that there is a credit balance that has paid the company more than expected.

Many business owners use their personal checking accounts for business transactions. Although having a business checking account is not a requirement for all businesses, it does come with many benefits. In the case of LLCs and corporations, having a separate business checking account is a legal requirement. If you haven’t incorporated or set up an LLC, you could technically use your personal checking account, but there are good reasons to get a separate business account instead.

- https://maximarkets.world/wp-content/uploads/2020/08/logo-1.png

- https://maximarkets.world/wp-content/uploads/2020/08/forex_team.jpg

- https://maximarkets.world/wp-content/uploads/2019/03/MetaTrader4_maximarkets.jpg

- https://maximarkets.world/wp-content/uploads/2020/08/forex_education.jpg

Being business owners or entrepreneurs, we’ve all been there. We have a great idea for a business, and we just want to get it started as soon as possible. This sometimes means considering the use of a personal account for business reasons as a way to save time.

Our business startup packages include everything you need to not only register your business but get your bank accounts ready as well. A business account allows you to control your business finances separately. It lets you do more with your money, such as make electronic transfers and pay with a business card.

These are just some of the questions that need to be answered in order to find out which type of bank accounting is right for you. If you have a high credit utilizationon your business credit card, it won’t affect your credit score. If you plan to open a merchant account to accept credit card payments, the bank may ask for an estimate of your monthly payment card sales. Business bank accounts may allow you to get debit cards for your employees so they can make purchases and deposits or withdraw cash at ATMs. You’ve had an illustrious career and saved some money—but now you’re ready to relax and enjoy your golden years and hard-earned money. However, you want to maintain a good credit score and you’re not sure how financial intuitions might assess your creditworthiness.